tax on forex trading in canada

It is for those whose main source of business is not Forex trading. Tax in Canada for Forex Trading.

7 Day Trading Rules In Canada Simplified Investing 101

It is the tax you must pay on your Forex trading earnings if you are trading as an investor.

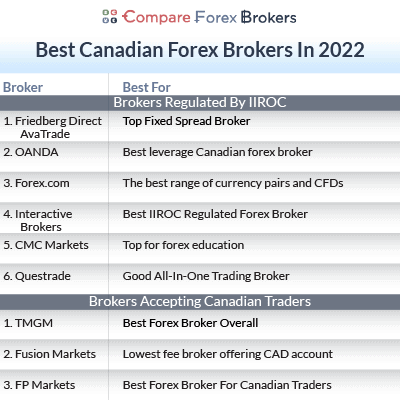

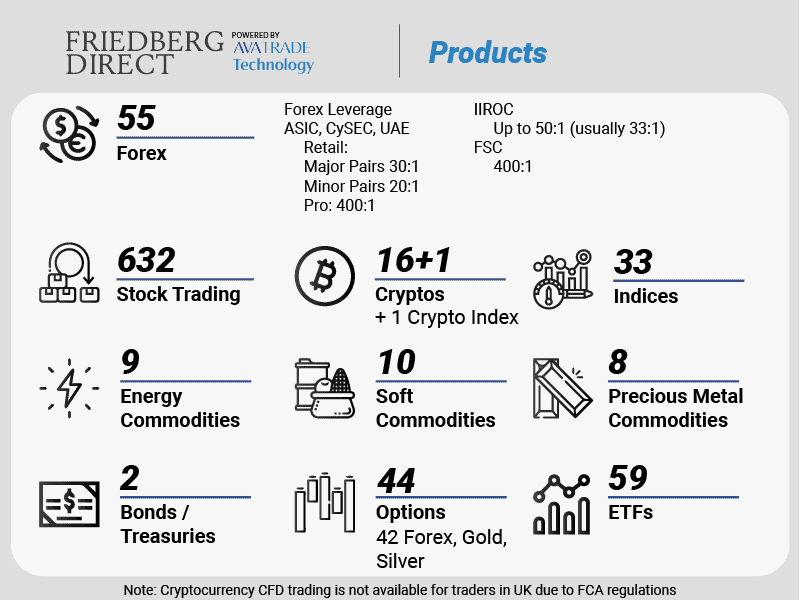

. Hey everyone some more content for you. But we highly recommend traders trade only with IIROC-regulated forex brokers. According to this.

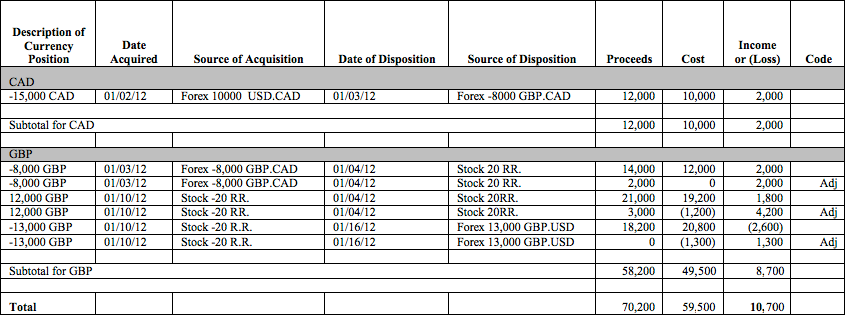

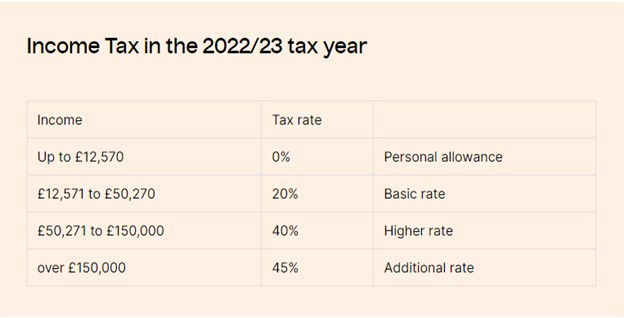

Canadian tax laws on currency trading are another topic of interest. For example in Canada traders pay taxes on Forex based on a rate of 50 of your marginal tax rate. Forex Trading Courses 828 Views.

Analysts at CIBC point out that for the third quarter as a whole inflation-adjusted. Yes forex traders pay tax in the United Kingdom. When you get to New.

Forex short for foreign exchange is the buying and selling of global currencies. With some assets its pretty clear-cut as to whether they will be treated as income or capital gains. Is it only when I withdraw the funds.

Learn to Day Trade. Finally for taxable income above 265327 a 45 tax is applicable. As for the professional traders who make hundreds of thousands of dollars.

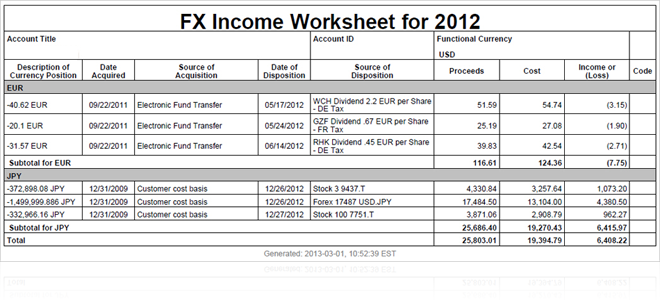

Foreign exchange gains or losses from capital transactions of foreign currencies that is money are considered to be capital gains or losses. Ive heard that Forex uses the 6040 rule with 60 of gains or losses treated as long-term capital gains. I just started trading forex a few months ago and went from 10k to 14k on Oanda.

In Canada it is important to pay taxes when you make a. As an option people who are not willing to pay income. Forex Trading Courses 1382 Views November 17 2020 Opening your OWN Business as a Day Trader Why you should treat day trading like a business.

However here you only have to pay. 22 hours agoJoin Telegram. Modern forex trading has digitized a relatively old method of making money.

November 4 2022 855 AM UTC in News. Httpsbitly36x4Dy1Get my FREE Journal Watchlist. The top tax rate of 42 applies to taxable income above 55961.

For example assume that you are a Canadian traveler with C10000 in cash. It could be business income. Heres a neat USDCAD.

The trade surplus widened in September but less than expected in Canada. Forex trading sometimes referred to as FX trading involves simultaneously buying one. If you trade CFD forex or spot you need to pay taxes of 10 if you earn less than 50000 or 20 for profits above 50000 the tax-free limit.

Planning on trading the NFP and Canadas jobs release. If youre an investor infrequent trades with long-term investing horizon youll treat any profits as a capital gain. That isnt saying how its treated.

The CRA says you treat it as capital gainslosses translated into Canadian dollars if the gain or loss is more than 200 CAD. Been investing in crypto since 2016 Author has 83 answers and 899K answer views 1 y. All this is leading up to the good stuff how I actually day trade my money management my psychology towards the m.

5 rows Under IRC section 1256 contracts forex traders are taxed using the 6040 rule. When do I have to pay taxes. This means 50 of your gains are taxed at your marginal tax rate.

Daily Forex News and Watchlist.

Top 5 Forex Brokers In Canada October 2022 Forexonlinebrokers

Top 8 Best Trading Apps In Canada 2022

What Does Trade Size In Mean In Forex Trading

Forex Trading Canada 2022 Best Forex Brokers Forexcanada

Day Trading Taxes In Canada 2022 Day Trading In Tfsa Account Youtube

Best Forex Brokers Canada 2022 Top Canadian Forex Brokers

10 Best Canadian Forex Brokers In Nov 2022 Iiroc Regulated

Which Countries Ban Forex Trading Forex Academy

Uk Tax In Forex Trading How Much Do I Pay 2022 Update

A Guide On Forex Time Canada Forex Canada

Taking Stock Of Tax Implications In Forex Trading Businessline On Campus

Is Forex Trading Allowed In Canada Earthweb

Tax Information And Reporting Fx P L Interactive Brokers U K Limited

Which Country Is Best For Forex Trading

Do I Have To Pay Tax On Forex Trading Tax Rates By Country Forex Education

All You Need To Know About Forex Trading In Canada The European Business Review